Ex-IRS Criminal Investigator Now Working for You!

Significant tax debts and financial fraud can cripple your financial stability. Don’t let these issues escalate. Nordlander CPA’s forensic accounting experts will:

- Tackle your IRS tax troubles

- Investigate financial fraud

- Restore your peace of mind

(336) 421-2392

Are you facing

IRS Tax Problems?

Get expert tax debt relief and negotiate with the IRS for a favorable resolution.

The Need for Litigation Support as an Attorney?

Strengthen your case with our detailed financial analysis and expert testimony.

The Need for Forensic Accounting Expertise or Training for Your Accounting Firm?

Enhance your firm's capabilities with our specialized forensic accounting course and support.

Divorce and Belief That Your Spouse Is Hiding Money?

Uncover hidden assets and ensure a fair settlement from our fraud examiners.

Suspicions About Business Partners or Employees Committing Fraud?

Protect your business with our discreet fraud detection and prevention strategies.

His Cases Were Covered By

Explore Our Services

Services

Dealing with complex financial investigations or tax disputes?

Quick action is essential to avoid bigger issues. Our forensic accounting services can help you tackle these challenges, keeping your business safe and compliant.

Forensic Accounting Services

Forensic Accounting

Investigate financial discrepancies and uncover the truth.

Whether for legal proceedings or internal investigations, expert forensic accounting can reveal hidden assets and fraudulent activities.

Divorce Examination

Protect your interests in high net worth divorces.

We examine records for hidden assets and income and provide expert advice on the most tax-advantageous ways to split assets and liabilities.

Internal Investigations

Conduct thorough internal investigations with expert support.

We help trace embezzlement, organize cases for prosecution, and recommend fraud prevention measures, ensuring business integrity.

Bankruptcy

Pursue fair outcomes in bankruptcy proceedings.

With forensic examinations, we help uncover hidden assets and ensure compliance with….

Civil Litigation

Strengthen your case with a detailed financial analysis.

Our forensic accounting services provide crucial support in civil litigation, helping you achieve….

Criminal Defense

Defend against white-collar criminal charges.

With expertise in forensic accounting, we offer comprehensive support for criminal defense….

Tax Resolution Services

Client Testimonial

We have had the privilege of having Nordlander CPA represent us through an IRS review. What a stressful time. Fortunately, Robert’s experience and expertise, led us through the maze of paperwork and the dreaded day long interview process. Highly recommend his services.

Back Taxes Help

Resolve overdue taxes and avoid penalties.

Expert guidance and support will help you manage and settle unpaid taxes, preventing….

IRS Audit Help

Proceed through IRS audits with confidence.

We provide expert guidance and representation to ensure that your interests are protected…

Payroll Tax Relief

Resolve payroll tax issues and avoid severe penalties.

From reviewing transcripts to representing you before the IRS, we help manage unpaid….

Tax Debt Relief

Find solutions for your outstanding tax debts.

Our strategic approach to tax debt relief helps you manage and resolve back taxes,…

Meet Robert Nordlander, the Driving Force Behind Nordlander CPA!

Why Us

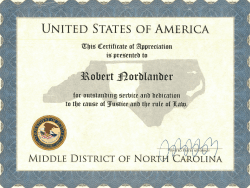

- Robert brings 20 years of experience as a special agent with IRS-Criminal Investigation to his boutique forensic accounting and tax resolution firm.

- His expertise in complex white-collar investigations allows him to uncover schemes, trace hidden assets and income, and communicate accounting in clear, understandable terms.

- In addition to his professional practice, Robert actively educates tax professionals and attorneys in the field of forensic accounting, ensuring they have the skills and knowledge to unwind complex financial investigations.

As a former IRS employee, Robert is uniquely qualified to resolve tax problems. He understands the IRS’s power to garnish wages, levy bank accounts, and place liens on property. With Robert as your advocate, you’ll have an expert who knows how to effectively deal with the IRS and protect your best interests.

Robert Nordlander

CPA, CFE, & Former IRS Criminal Investigator (Author & Speaker)

His Accolades

Know How We Work With You!

Discovery/Consulting

We begin with a discovery call to get to know your financial situation and goals. This initial conversation helps us understand what you need and how we can help.

In-Depth Investigation

Our investigations involve gathering all relevant financial data, interviewing key personnel, and examining internal controls. We dig deep to uncover any potential misconduct or irregularities, ensuring a thorough analysis.

Clear and Detailed Reporting

After the investigation, we provided a comprehensive report outlining our findings. This report includes clear evidence of any issues and actionable recommendations for addressing them, designed to withstand critical analysis.

Expert Litigation Support

Should the need arise, our accountant forensics team is prepared to act as expert witnesses in litigation. We provide strong, evidence-based testimony to support your case and help achieve a favorable outcome.

Robert has spoken at...

Find the Answers

Unpaid Payroll Taxes: A Time Bomb You Can Defuse

Amazon #1 Bestseller

This book is a vital resource for CPAs, enrolled agents, attorneys, and small business owners dealing with payroll tax issues. Learn how to prevent financial catastrophe by understanding the impact of unpaid payroll taxes and taking proactive measures.

Read the Amazon Bestsellers

E Books

Robert Nordlander unveils the secrets of tax resolution, unpaid payroll taxes, and how you can win financial fraud cases!

Erase the Penalty

#1 Bestselling New Release on Amazon

Authored by former IRS agents Robert Nordlander and C. Steven Boon, this essential guide offers strategies to mitigate or eliminate IRS penalties, which can reach up to 75% of the taxes due. Gain actionable insights from experts who have firsthand experience in dealing with these issues.

Explore the Bestsellers

Criminal Tax Secrets: What Every Defense Attorney Should Know

Amazon #1 Bestseller

Written for criminal defense attorneys, this book provides crucial knowledge on handling criminal tax investigations. With insights from Robert Nordlander’s 20 years of experience as a special agent, this book equips legal professionals to better defend their clients against financial crimes.

Client Testimonial

Robert is business associate of mine and an expert in his field. As a former Criminal Investigation Special Agent with IRS for many years & best selling author you will not find a better resource to solve your IRS case.

Extremely detail oriented, specialized and experienced CPA. If you are facing a difficult IRS or tax issue, Mr Nordlander can assist you in navigating through the situation and obtaining the best possible outcome for your specific situation

We have had the privilege of having Nordlander CPA represent us through an IRS review. What a stressful time. Fortunately, Robert’s experience and expertise, led us through the maze of paperwork and the dreaded day long interview process. Highly recommend his services.

I consulted with him on my financial situation. He was able to ask the right questions and quickly give me the help I need. I highly recommend.

Robert is very helpful and prevents you from experiencing tax problems and should you have any tax issues he will help you remediate them. His more that thirty years of experience are more than sufficient to take care of any tax problem. He knows the system from the inside out.

Robert did an excellent job working with me on several cases in the bankruptcy court. I would recommend him without hesitation, and have referred several colleagues to him.

Don’t Miss our Podcast

Fraud Fighter

Hosted by Robert Nordlander,

this podcast is heard in over 3,600 cities and 130 countries.

The Fraud Fighter Podcast is about fraud and forensic accounting, where guests are interviewed about fraud detection, prosecution, anti- money laundering, and careers in the industry.

FAQs

Absolutely. Nordlander CPA’s forensic accounting team offers expert litigation support, including serving as expert witnesses with robust, evidence-based testimony. We also maintain strict confidentiality protocols and adhere to industry best practices to ensure your financial information remains secure and is used solely for the investigation.

Nordlander CPA uncovers hidden assets and manages tax issues by tracing financial transactions, reviewing records, and detecting discrepancies. We also identify potential tax liabilities from property division and alimony, helping minimize tax burdens through strategic planning.

Proving theft requires a detailed investigation. Nordlander CPA excels in analyzing financial records to uncover hidden patterns and gather solid evidence for a strong legal case. Legal action can lead to recovering stolen funds, receiving compensation, and other legal remedies, supported by our expert analysis and testimony.

Unpaid payroll taxes can result in severe penalties, fines, and interest charges. Nordlander CPA can negotiate with the IRS on your behalf, set up payment plans, and guide you through relief programs to resolve your payroll tax issues and minimize financial and legal consequences.

Nordlander CPA ensures compliance with bankruptcy laws through detailed financial reviews. We provide expert reports, analysis, and testimony during legal proceedings, helping build strong cases against fraud. Robert Nordlander’s expert testimony further strengthens our support.

Our Forensic Accounting Course teaches you the skills needed for detailed financial investigations. You’ll learn practical techniques and gain the knowledge to handle complex financial cases confidently. This course prepares you to master forensic accounting and conduct thorough investigations.

If you get an IRS notice about back taxes, contact Robert Nordlander right away. He will carefully review the notice, explain what it means, and guide you through the steps needed to resolve the issue. He can help you communicate with the IRS, set up payment plans if necessary, and make sure you understand your options.

Embezzlement can be detected through unexplained changes in financial records, unauthorized transactions, and discrepancies between reported and actual income. Nordlander CPA can assist by performing a detailed investigation to identify these signs, providing evidence and analysis, and helping you take the necessary steps to address and resolve the issue effectively.

Facing IRS Complications or Financial Fraud?

We have the answer!

Whether you need forensic accounting, tax dispute resolution, or financial investigation support, we’re here to help.

(336) 421-2392